Cyprus Residence Permit/Residency by Investment Program Requirements

Becoming a Resident of Cyprus by Investment

Enjoying life in Cyprus

Welcome to Cyprus, a country that has been ranked the 5th best relocation destination in the world by an international lifestyle review (report prepared by Knight Frank, a leading independent, global real estate consultancy firm). Cyprus offers all the ingredients one would look for when choosing a country as a new home. It is strategically located and it offers high quality of life, full EU membership, excellent weather, security and safety for the whole family, excellent private schools, well-educated workforce and business friendly environment. Equally attractive is the Cyprus tax environment. The huge wave of international tax developments including the introduction of Russian controlled foreign companies’ regulations (CFC) as well as the adoption by many countries of the Common Reporting Standard for the Automatic Exchange of Information and the implementation of Base Erosion Profit Shifting (BEPS), make an individual’s tax residence status a matter of high importance..

Cyprus Permanent Residency Vs. Other Programmes

- It gives you, a Non-EU national, the right to permanently reside in Cyprus

- Exempts you from immigration entry procedures (i.e. visitor’s visa)

- Your family can also obtain it (married spouse, children under 18 years old, unmarried financially dependent children 18-25

years old, parents and parents-in-law) - The permit is granted for an indefinite duration

- Time frame for completion of the process is approximately 2-3 months

- No Greek language proficiency requirements

- No need to stay in Cyprus, but must visit at least once every two years.

Cyprus major benefits:

- Ranked 5th best place to relocate globally

- High living standard

- Sophisticated infrastructure

- Strong educational system

- Strong legal system based on the UK legal system

- Safe place to live

- Advanced healthcare

- Tax-friendly regime

- EU member

Requirements:

You must have:

A. Invested at least €300,000 in one of the following investment categories:

Investment in a house/flat

Under this category the purchase of a house/flat must be made by a developer company and it must concern a first sale unless the resale took place before 7/5/2013. The amount of EUR300, 000 excludes VAT.

Investment in real estate (other than house/flat)

Under this category the investment can be made in other types of real estate such as offices, shops, hotels or combination of the aforementioned. In this category the real estate can concern resales.

Investment in share capital of a Cyprus company with activities and personnel in Cyprus

Under this category the investment must take place in the share capital of a Cyprus company with proven physical substance and activities in Cyprus and which employs at least five (5) persons.

Investment in units of a Cyprus Investment Organization of Collective Investments (AIF, AIFLNP, RAIF)

Under this category the investor must invest in units of a Cyprus Investment Organization of Collective Investments (AIF, AIFLNP, RAIF).

B. Secured annual income of at least €30.000, increased by €5.000 for every dependent person (spouse and children)

and by €8.000 for every dependent parent or parent-in-law. In case you choose to invest in a house/flat (first category) this

income should derive from abroad from sources other than employment in Cyprus (i.e. dividends, rent, fixed deposits,

pension, salary etc.). In case you choose to invest in any of the other three investment categories your total secured annual

income may also arise from sources that derive from activities within the Republic of Cyprus.

C. A certificate of clean criminal record from your country of residence or from Cyprus in case you reside on the island.

D. Signed a confirmation that you do not intend to undertake any employment in Cyprus. However, in case you choose to

invest in the share capital of a Cyprus company you may hold the position of the Director in such company while if the

investment is made in one of the other categories you and your spouse may hold shares in Cyprus companies and also hold

the position of a Director in such companies without receiving a salary.

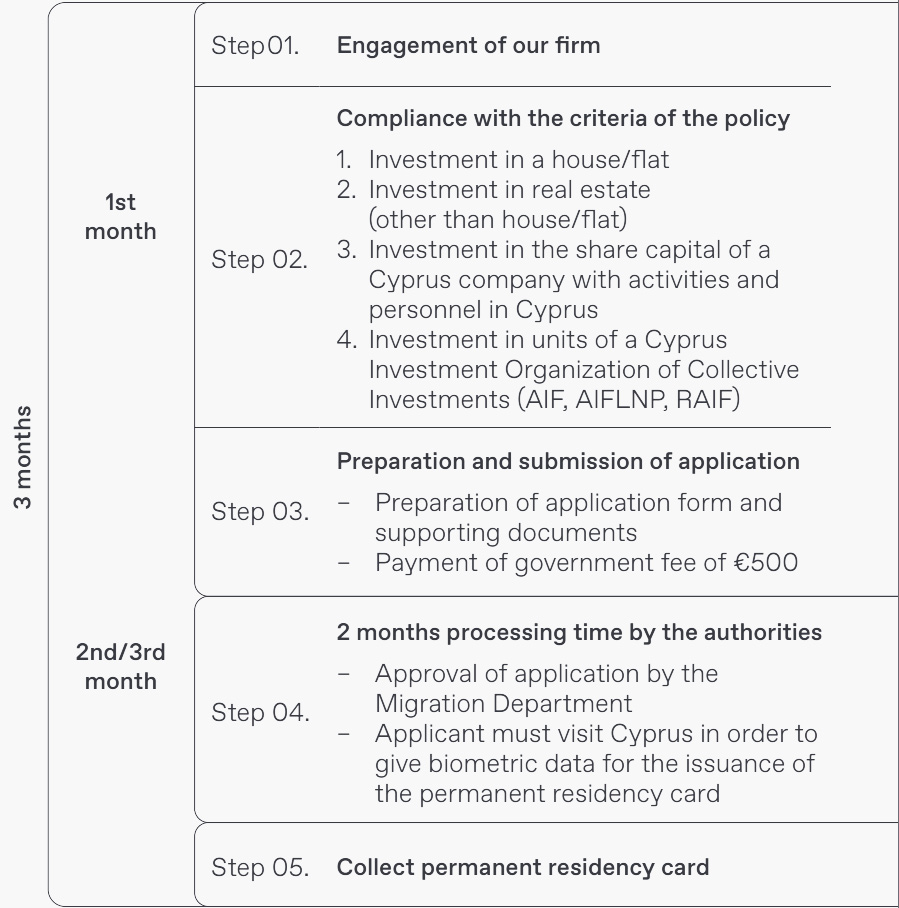

Process & timeline for obtaining permanent residency in Cyprus:

The above procedure and timeline diagram is indicative only. Vardikos & Vardikos is not responsible for any changes to the estimations; exact time and cost estimates will be provided individually.

Taxation

An individual is tax resident of Cyprus if he/she is present in Cyprus for more than 183 days in a tax year or if he satisfies

cumulatively the following criteria:

– Not living in any other country more than 183 days and not being tax resident in any other country

– Stays in Cyprus for at least 60 days in a calendar year – Carries on any business in Cyprus and/or is employed in Cyprus and/or holds an office (director) in a company tax resident in Cyprus at any time in the tax year

– Maintains a permanent house in Cyprus which is either owned or rented by the individual

He /she would be under normal circumstances subject to tax on worldwide income under both the income tax law and the special defence contribution (SDC). Under SDC the individual is taxed on dividends (17%) passive interest (30%) and rental income (3%).

However with the introduction of the non-domicile regime, with effect from 16 July 2015, a Cyprus tax resident individual with non-domicile status will not be subject to SDC on dividend, passive interest and rental income wherever arising.

Who can qualify for the non-domicile status:

A person has, at any given time either:

- the domicile acquired by him/her at birth (‘domicile of origin’), or

- the domicile acquired by him/her by his/her own act (‘domicile of choice’) having shed the domicile of origin.

Based on the above, a person who was not born in Cyprus and was not a Cyprus tax resident 17 out of the last 20 years, will be considered as non-domiciled in Cyprus and can take advantage of the provisions of the non-domicile regime.

Other tax advantages for all tax residents:

- No tax on profit arising from the disposal of titles such as shares, debentures, bonds and other financial instruments as listed in a tax office circular

- Nil or reduced withholding tax on dividends, interest, royalties and pensions received from abroad in accordance with the tax treaties signed with other countries

- No tax on any lump sum received as a retirement gratuity

- Flat rate of 5% on pension income received from abroad exceeding €3.420

- No capital gains tax (CGT) on the sale of real estate situated outside Cyprus

- No estate duty, wealth tax, gift tax or inheritance tax in Cyprus

- Tax exemption of 50% of gross employment income, available for 10 years, for an individual earning more than €100.000 of gross employment income per annum in Cyprus provided that the individual had been resident outside of Cyprus before the commencement of the employment in Cyprus

- Tax exemption of 20% of gross employment income (up to a maximum of €8.550) for an individual that had been resident outside of Cyprus before the commencement of the employment in Cyprus. This exemption is available for 5years and applies to new employees coming to Cyprus until the year 2020. This exemption is not available together with the exemption immediately before

- No tax on employment income earned for offering salaried services to an overseas employer or to an overseas permanent establishment of a Cypriot employer for more than 90 days in a tax year

- The taxable income of an individual tax resident of Cyprus up to €19.500 per annum is taxed at zero rates.

How can we assist?

-

Conduct an examination of your specific circumstances and advise on the most efficient way to meet the required financial criteria

-

Assist in finding and acquiring the right investment fulfilling the criteria

-

Assisting with the opening of a bank account at a local bank

-

Assisting in drafting and collecting the required documentation

-

Preparing and submitting on your behalf the complete application to the authorities

-

Monitoring the status of the review of the application by the authorities.

Brochures

Cyprus Permanent Residency by Investment

For any further information or clarifications please do not hesitate to contact us at: [email protected]

Alternatively, and for any other inquiries, please call us direct via +306932488888.

Get in touch

Call Us

Tel. No. GR: +30 210 3627888-9 | +30 210 361 1505 | +30 6937 22 88 88 | +30 6934 555 555

Tel. No. DOMINICA: +17672853888 | +17672751888

Tel. No. UAE: +971506689558

Tel. No. MALTA: +35699884534

Tel. No. CYPRUS: +357 99 202422 | +357 22 332040

Emergency and A.O.H.: +306934555555 , +306937228888

Fax: +30 210 361 78 48

Address

4 Koumbari Street,

Kolonaki Square,

Athens, 10674 Greece

www.vardikos.com | [email protected]

Dominica Office :

36 Great George Street Roseau

Commonwealth of Dominica

00112 West Indies

St Lucia:

20, Micoud Street, Castries

P.O. Box 189

Saint Lucia

Cyprus Office:

Flat 210

2-4 Arch. Makarios III Av.

1065 Nicosia, Cyprus

Email Us

General Inquiries:

[email protected]

[email protected]

IP Practice:

[email protected]

Shipping Practice:

[email protected]

Dominica Office:

[email protected]

St Lucia Office:

[email protected]

Send us your message